No. 34 (558) May 2025

WORLD BANK ROUNDTABLE ON FINANCING TRANSBOUNDARY BASIN DEVELOPMENT. PART 1: TRADITIONAL FINANCING MECHANISMS

The first session of the World Bank Roundtable on Financing Transboundary Basin Development gathered experts and decision-makers from around the world to explore financing challenges and solutions for transboundary water cooperation, with focus on traditional financial mechanisms. It highlighted persistent gaps between the growing financial needs of basin organizations and the limited availability of stable funding, and explored pathways for improving financial resilience and institutional stability. The session was opened by Saroj Kumar Jha, Global Director for Water at the World Bank, who stressed the urgency of creating robust and sustainable financing systems to support transboundary basin institutions and achieve long-term cooperation outcomes. He welcomed participants and set the tone for the discussions by outlining the persistent gap between the growing financial needs of basin organizations and the limited availability of stable funding.

The event continued with a presentation by Dr. Susanne Schmeier of IHE Delft, who stressed that financial resources are a frequently underestimated yet critical element of transboundary basin governance. Dr. Schmeier outlined the wide range of financing needs, from maintaining institutional operations and data management to infrastructure development and the delivery of basin cooperation activities. Traditional public financing sources, including member state contributions and development assistance, were contrasted with private sector involvement, which remains limited due to high perceived risks and low expected returns. Dr. Schmeier concluded with a call for basin countries to strengthen institutional frameworks, mobilize domestic resources, and better align with external donors and potential private investors.

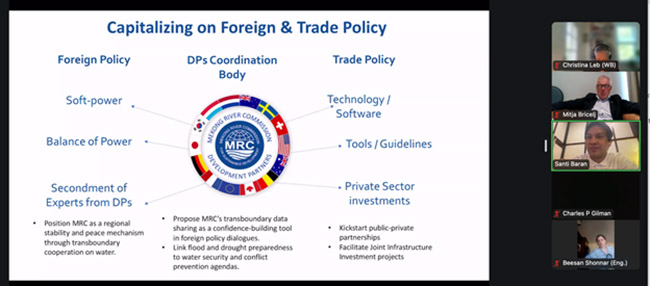

The second presentation was delivered by Mr. Santi Baran from the Mekong River Commission Secretariat (MRCS), who introduced the MRC's well-developed dual financing mechanism. This includes a pooled Basket Fund composed of member country and donor contributions for core functions, and Earmarked Funds for targeted donor-supported activities. Mr. Baran also presented the concept of the future Mekong Fund, which would require hydropower developers to contribute a portion of their revenue toward cooperative basin management. He emphasized the MRC's role as a platform for stability and conflict prevention, promoting regional data-sharing as a tool for confidence-building and disaster risk reduction.

Ms. Birgit Vogel, representing the ICPDR (Danube Basin), presented a contrasting model based on strong and predictable member state contributions with limited reliance on external donor cycles. She underlined that this approach enhances operational stability and reduces vulnerability to shifting donor priorities.

In the responder segment, Dr. Dinara Ziganshina of SIC ICWC explained how financing arrangements in Central Asia differ from more centralized pooled systems. Central Asia applies a mix of financing models tailored to specific institutional contexts, levels of trust, and administrative realities. Core operational costs of regional organizations such as SIC ICWC and Basin Water Organizations, as well as operation and maintenance of water infrastructure serving multiple countries, are funded by the budgets of the host countries as their contribution to IFAS. This system has been in place for over 30 years. Programmatic costs are partly covered by national budgets and partly by donor assistance. Dr. Ziganshina highlighted that permanent organizations like SIC ICWC and the BWOs benefit from stable teams and fixed locations, which enhances their ability to attract donor support and implement projects. However, she also noted the perceived challenge of bias due to the location of these organizations in one country. In contrast, rotating institutions like the IFAS Executive Committee, which changes every three years, offer equal representation and bring new ideas, but face challenges such as disrupted continuity, frequent leadership changes, and difficulties in securing long-term external funding.

The roundtable closed with additional insights from Kevin Chrétien (DG INTPA) and Dimka Skeie Stantchev (SDC), who reinforced the importance of adapting financing models to regional needs and maintaining a balance between stability and flexibility. The second session of the roundtable is scheduled for July 2025, where the focus will shift to innovative and emerging financing mechanisms to complement traditional sources.